Das Jahr 2020 ist mit Änderungen des Mehrwertsteuerrechts gestartet. Den Neuerungen und ihrer Umsetzung in der Praxis widmen die AWB Steuerberatungsgesellschaft und die AWB Rechtsanwaltsgesellschaft ein Webinar im Rahmen ihrer Frühjahrstagung 2020, dem 1. Digitalen AWB Business Breakfast. Ein Fokus liegt auf der Bedeutung der Umsatzsteuer-Identifikationsnummer (USt-IdNr.) im Kontext der Steuerbefreiung bei innergemeinschaftlichen Lieferungen.

Am Beispiel der CheckVAT Web-Applikation wird ClearVAT während des Webinars die Möglichkeiten zur revisionssicheren Prüfung der USt-IdNr. europäischer Handelspartner vorstellen. Das browserbasierte und damit plattformunabhängige Tool ermöglicht eine automatisierte Abfrage einzelner und vor allem auch mehrerer USt-IdNr. gleichzeitig. Dafür nutzt CheckVAT seine Schnittstelle zum Bundeszentralamt für Steuern sowie zum europäischen VAT Information Exchange System (VIES). Eine Stammdatenprüfung deutscher Handelspartner kann mit der Web-Applikation ebenfalls umgesetzt werden. Entwickelt wurde es mit fachlicher Unterstützung der AWB Steuerberatungsgesellschaft. Mehr zu den Funktionen finden Sie auf unserer Produktseite.

Das AWB Business-Webinar findet am 23. Juni 2020 von 10 bis 13 Uhr statt.

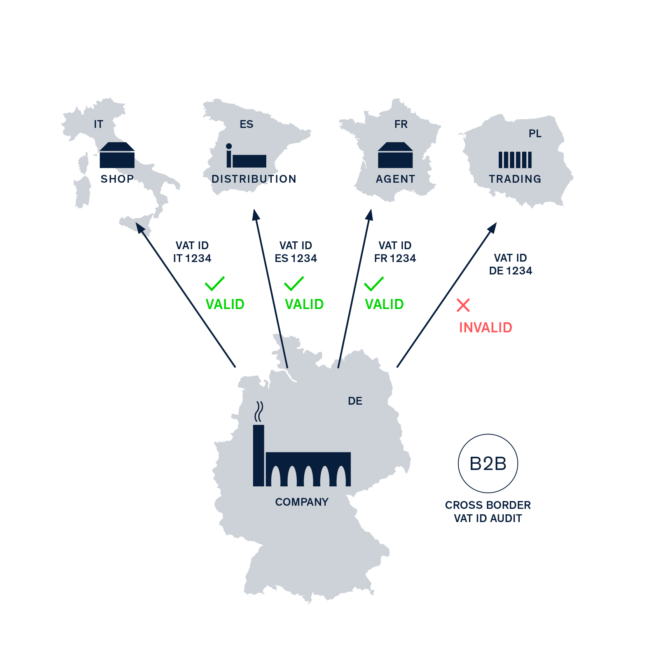

Hintergrund: Die Steuerbefreiung für innergemeinschaftliche Lieferungen ist seit Jahresbeginn 2020 strenger geregelt. Werden Waren innerhalb der EU an einen Unternehmenskunden versendet, muss der Abnehmer dazu in dem jeweiligen Land umsatzsteuerlich erfasst sein. Dazu benötigt er eine Umsatzsteuer-Identifikationsnummer. Die Angabe der gültigen USt-IdNr. des Abnehmers als Bestandteil einer vollständigen Zusammenfassenden Meldung (ZM) ist nun ausdrückliche Voraussetzung für die Steuerfreiheit von innergemeinschaftlichen Lieferungen (§ 6a Abs. 1 Nummer 4 UStG). Gleichzeitig trägt der Lieferanten die Verantwortung dafür, dass die in der Zusammenfassenden Meldung dokumentierte USt-IdNr. des Abnehmers im Zeitpunkt der Lieferung gültig ist. Wird dem nicht entsprochen, entfällt die Steuerbefreiung.

Online-Überprüfung der Umsatzsteuer-ID

Handeln Sie jetzt: Stellen Sie sicher, dass Ihre USt-IdNr. in allen EU-Mitgliedstaaten korrekt validiert wird. Nutzen Sie unsere umfassenden Ressourcen für Sofortüberprüfung, Echtzeit-Genauigkeit und branchenführende Sicherheitsstandards, um eine vollständige Compliance im grenzüberschreitenden Handel zu gewährleisten.